All major market segments saw seasonally adjusted prices that remained lower year over year in the first half of August, yet the declines have been slowing recently.

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 0.5% from July in the first 15 days of August, according to the mid-month Manheim Used Vehicle Value Index released Aug. 19.

The index increased to 202.6, which was down 4.5% from August 2023. The seasonal adjustment softened the results for the month. The non-adjusted price change in the first half of August rose 1.6% compared to July, while the unadjusted price was down 5.2% year over year. The average rise for August is an increase of four-tenths of a point for seasonally adjusted values, so the current change is in line with longer-term trends.

“The industry clearly experienced strength in wholesale values for the full month of July, and that trend has continued so far into August,” said Jeremy Robb, senior director of economic and insights at Cox Automotive, in a news release. “The three-year-old segment is the largest at Manheim, and wholesale values for those units have increased for five weeks in a row. Recently, we have seen the strength broaden out, as values for some of the older segments have also seen small gains week over week.”

During the last two weeks, the Manheim Market Report (MMR) prices in the Three-Year-Old Index reversed course and increased an aggregate of 0.4%, which was above the typical normal decline of 0.2% observed at this time of year. Over the first 15 days of August, MMR Retention, the average difference in price relative to current MMR, averaged 99.4%, indicating that valuation models have moved closer to market prices early in August. MMR retention is up six-tenths of a point compared to the prior year at the beginning of August, and it is a bit stronger than the last two years.

The average daily sales conversion rate of 63.4% in the first half of the month was above the August 2019 daily average of 60% and has clearly moved higher in the last two weeks. The conversion rate has risen four full points from July 2024, indicating the market is seeing stronger buying demand in recent weeks.

Vehicle Segment Prices Remain Below 2023 Levels

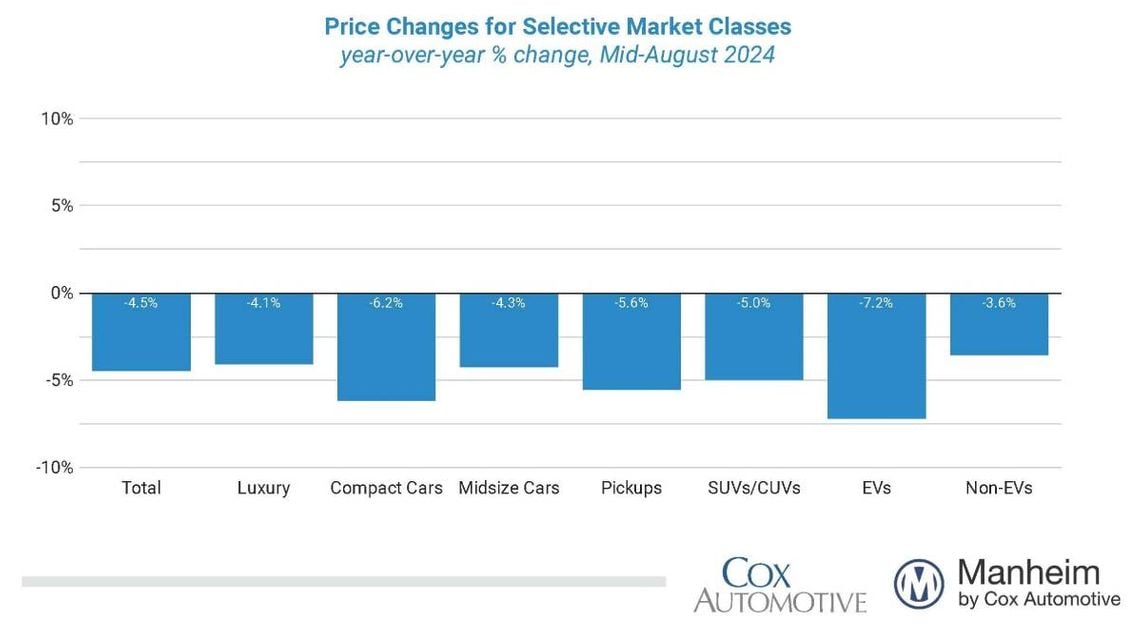

All major market segments saw seasonally adjusted prices that remained lower year over year in the first half of August, yet the declines have been slowing recently. Compared to the industry’s year-over-year decline of 4.5:

- The luxury segment declined by 4.1% against 2023

- Midsize cars fell by 4.3% over the same period.

- Falling more than the average, SUVs were down 5%

- Pickups fell by 5.6%

- Compact cars declined 6.2% year over year.

Comparing results against the end of July, almost all segments rose. The overall industry rose by 0.5% against the prior month, and the luxury segment was higher by 2.3% with midsize cars increasing by 1.2%. The SUV segment rose less than the industry overall, increasing 0.4%, and the pickup segment was higher by 0.2% against July 2024. The compact car segment declined 0.4% month over month.

Seasonally adjusted electric vehicle (EV) values for the first half of August were down 7.2% against August 2023, while the non-EV segment decreased by 3.6% over the same period.

Compared to July, EVs increased 4.4% in the first half of August, while non-EVs were up 1.1% in the month.

Wholesale Supply Is Down in Mid-August

Leveraging Manheim sales and inventory data, Cox estimates that wholesale supply ended July at 27 days, up one day from the end of June yet down one day against July 2023 at 28 days. Wholesale supply is relatively normal for this time of year, running basically one day lower longer-term levels for this week. As of Aug. 15, wholesale supply decreased by two days from the end of July, moving to 25 days, flat against year-over-year levels.

Measures of Consumer Sentiment Showing Mixed Trends

- The initial August reading on consumer sentiment from the University of Michigan increased 2.1% to 67.8, which was a bit stronger than expected. If that level holds or is better for the month, it will end a four-month streak of declines, but sentiment remains very low and down 2.3% year over year. Future expectations drove the increase as views of current conditions declined. Expectations for inflation in one year and in five years were unchanged from July. Consumers’ views of buying conditions for vehicles improved slightly but remain at very low levels. Consumers’ views of vehicle prices and interest rates remain very negative.

- The daily index of consumer sentiment from Morning Consult is unchanged in mid-August though sentiment has been somewhat volatile. The index increased 2.9% in July and was up 4% against last year as of Aug. 15. Sentiment is up 1.1% year to date.

- The average unleaded gas price, has decreased 1.4% month to date to $3.43 per gallon as of Aug. 15, according to AAA. Gas prices are down 11% year over year but up 10% year to date.