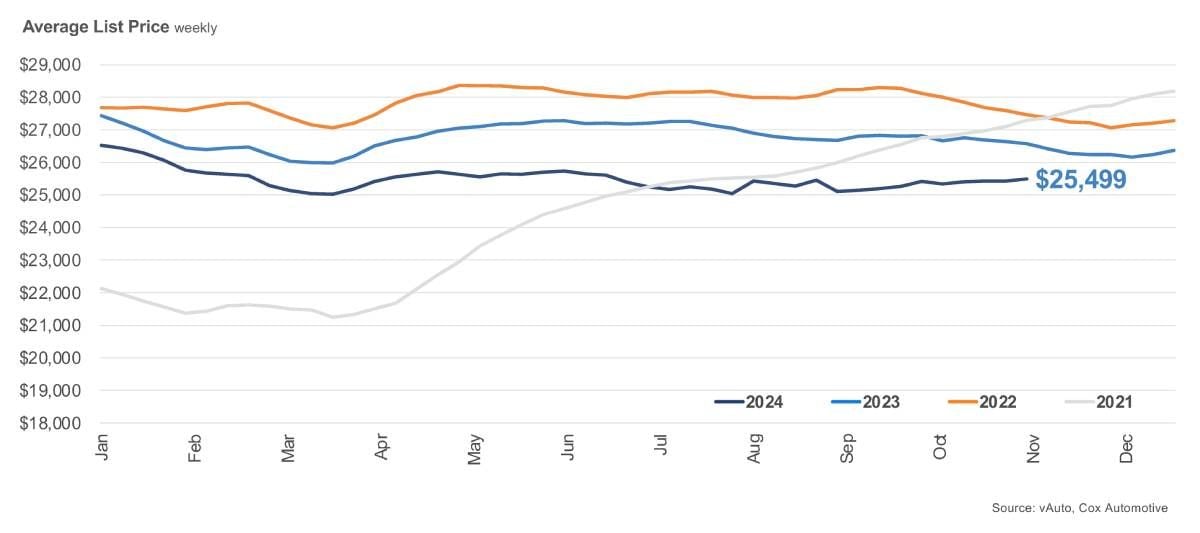

The average used vehicle listing price was $25,499, up from the revised $25,339 at the start of October and now down 4% from a year earlier.

Used-vehicle inventory levels at the start of November were higher than in October but lower than in early November 2023, according to the Cox Automotive analysis of vAuto Live Market View data.

As November opened, the total supply of used vehicles on dealer lots — franchised and independent — across the U.S. was 2.17 million units, up from 2.15 million units at the start of October and down 6% from a year ago.

The retail used-vehicle sales pace increased monthly in the most recent 30-day period. Used retail sales of 1.44 million vehicles at the start of November were higher than the 1.35 million reported at the start of October, an increase of 7%. Despite Hurricane Milton most likely disrupting some sales at the beginning of October, used-vehicle sales were strong last month and higher year over year by 12%.

The Cox Automotive days’ supply is based on the estimated daily retail sales rate for the most recent 30-day period. In early November, the days’ supply was 45, down three days from the beginning of October and nine days compared to last year. This trend indicates that used-vehicle inventory is tighter despite the monthly rise in vehicles listed.

The average used vehicle listing price was $25,499, up from the revised $25,339 at the start of October and now down 4% from a year earlier. The increase in the average listing price for a used vehicle was primarily due to a mix shift. In October, the mix comprised a higher percentage of younger vehicles, particularly due to a seasonal surge of 2024 model-year units entering the used market. Retail used-vehicle listing prices have been consistently lower through the first 10 months of 2024 than year-ago levels.

Affordability remains challenging for consumers, and supply is more constrained at lower prices. Used cars below $15,000 continue to show low availability, with only 33 days’ supply, seven days lower than last year and 12 days below the industry average.

The top five sellers of the month were listed at an average price of $23,931, about 6% below the average listing price for all vehicles sold. Once again, Ford, Chevrolet, Toyota, Honda, and Nissan were the top-selling brands, accounting for 51% of all used vehicles sold.