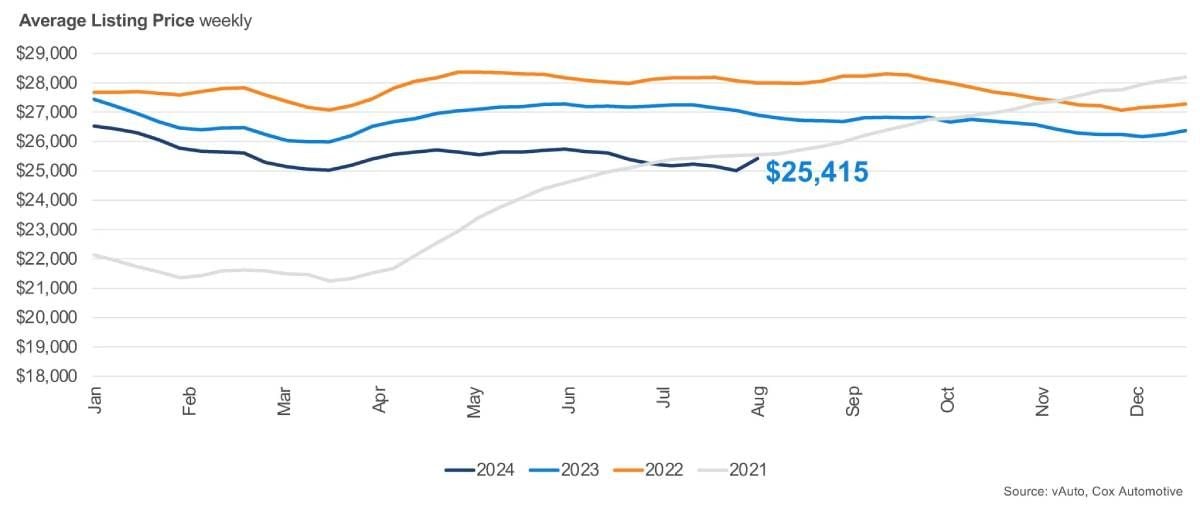

The average used-vehicle listing price was $25,415, up from the revised $25,246 at the start of July but down 5% from a year earlier.

Used-vehicle inventory levels at the start of August were lower than in July and down 3% from this time last year, according to the Cox Automotive analysis of vAuto Live Market View data released Aug. 16.

As August opened, the total supply of used vehicles on dealer lots – franchised and independent – across the U.S. was at 2.17 million units, down from the 2.22 million units at the start of July.

The dealer management system (DMS) outage that disrupted sales and inventory reporting over the previous month continues to create volatility in reporting. As of June 30, the impacts ended up inflating days’ supply levels and lowering sales, and that is now unwinding and delivering much variability for those data series but in the other direction as the full picture July.

The market saw a large increase in sales for both new and used vehicles, most notably at the end of the month, which drove measures of days’ supply lower. Although Cox estimates an increase in used retail sales for July compared to June, the disruption continues to make it challenging to provide an accurate report, with the truth for both months probably somewhere in between.

Inventory levels of both new and used vehicles decreased through July. However, the outage appears to have had less of an impact on the used-vehicle market. Used-vehicle days’ supply at the start of August was 41 days, down 12 days from the beginning of July and down seven days from last year.

The Cox Automotive days’ supply is based on the estimated daily retail sales rate for the most recent 30-day period, when sales were 1.6 million units. Used-vehicle sales in the period were up 27% month over month and nearly 15% year over year.

The average used-vehicle listing price was $25,415, up from the revised $25,246 at the start of July but down 5% from a year earlier. The increase in the average listing price was mostly due to a mix shift where the number of 0-to-2-year-old vehicles made up a larger portion of the vehicles sold. Retail used-vehicle prices have been consistently lower through the first seven months of 2024 compared to year-ago levels and are now down below where they were at the same time in 2021.

However, affordability remains challenging for consumers, and supply is more constrained at lower price points. Used cars below $15,000 continue to show low availability, with only 31 days’ supply, 29% less than the market total. The top five sellers of the month were listed at an average price of $23,922, about 6% below the average listing price for all vehicles sold. Once again, Ford, Chevrolet, Toyota, Honda and Nissan were the top-selling automakers, accounting for 51% of all used vehicles sold.