November saw steady growth in sales of new and used EVs, with inventory tightening and the gap between EVs and ICE+ models narrowing.

As 2024 closes out, the U.S. electric vehicle (EV) market looks to finish with momentum in sales, supply, and prices, according to Cox Automotive figures released Dec. 19.

November saw steady growth in sales of new and used EVs, with inventory tightening and the gap between EVs and ICE+ models narrowing. The average transaction price for new EVs and the average listing price for used EVs saw slight decreases, reflecting market conditions.

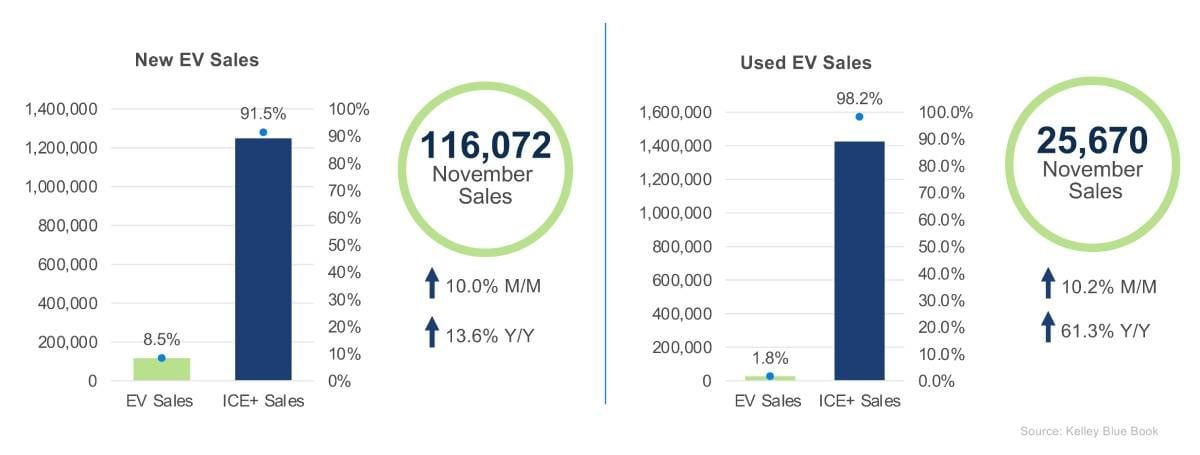

New EV Sales: In November, new EV sales reached 116,072 units, marking a 10% increase month over month and a 13.6% increase year over year. This was the second-highest volume for the month this year, achieving an 8.5% market share. The Tesla Model Y and Model 3 held the top spots for volume, with the Honda Prologue coming in at No. 3. Incentives help drive sales, reaching a year-high of 14.9% of the average transaction price.

Used EV Sales: Used EV sales continued to grow strongly, reaching 25,670 units, a 10.2% increase monthly. This brought the market share to 1.8% for the second time this year. Sales increased by 61.3% year over year. The Tesla Model 3 had the highest volume sold, followed by the Tesla Model Y and the Chevrolet Bolt.

New EV Days’ Supply: In November, the new electric vehicle days’ supply was 93 days, marking a 13.8% decline month over month. This was the smallest gap of the year compared to ICE+ vehicles. The decline resulted from discounts and incentives boosting sales and automakers adjusting production.

Used EV Days’ Supply: The used EV days’ supply declined by 5.2% month over month, dropping to 45 days in November, making it comparable to ICE+ days’ supply. Year over year, days’ supply is down 29.6%. The tightening of used inventory continues.

The average transaction price for new EVs and the average listing price for used EVs saw slight decreases, reflecting market conditions.

New EV Average Transaction Price: The average transaction price for EVs in November was $55,105, a decline of 1.8% month over month but an increase of 1.4% year over year. The price premium over ICE+ vehicles was $6,940. Jaguar, Audi, and Porsche had the largest monthly price declines, while Volkswagen and Mercedes-Benz had the largest increases month over month.

Used EV Average Listing Price: The average listing price of used EVs decreased by 1.3% month-over-month in November to $37,341. However, it remains 10.3% lower compared to the previous year. Acura, Honda, and Mazda saw the largest price listing declines month over month, while BMW and Nissan experienced the largest increases.