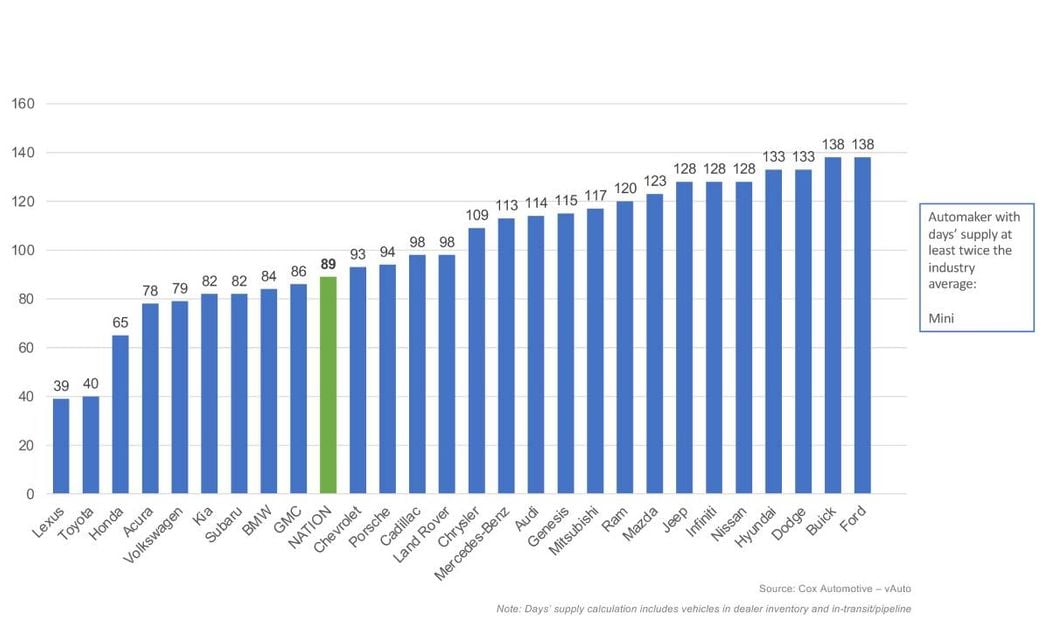

Over the last year, Hyundai has gained the most days’ supply, up 38 days yearly, while Jeep and Ram have dropped the most, down 54 and 56 days, respectively.

With a hotter sales pace in February, new-vehicle days’ supply dropped to 89 days, a 10% decrease compared to the start of February, according to vAuto Live Market View data released March 13.

While concerns about future price increases may be driving more customers to the showroom, uncertainties in policy changes are creating challenges for automakers as they await further information. Over the last year, Hyundai has gained the most days’ supply, up 38 days yearly, while Jeep and Ram have dropped the most, down 54 and 56 days, respectively.

It points to February as a solid month for new vehicle sales. The 30-day sales pace increased by 13.6% compared to January and rose 5.9% yearly. At the start of March, the total U.S. supply of available unsold new vehicles was 2.99 million units, reflecting a 2.2% increase from the start of February and a 12.8% increase from a year ago. With greater inventory availability, dealers had market confidence, and consumers had plenty of options when choosing a new vehicle.

Toyota, Ford, Chevrolet, Honda, Hyundai, and Kia were again the six best sellers in February, accounting for 58% of all sales and 53% of all vehicle inventory. While the average listing price of all sales is $48,316, these six best sellers averaged $42,524. As interest rates continue to rise, challenging affordability, these six manufacturers offer over 40 models listed below that average listing price, with an additional 50 models at or below this price.

Available unsold inventory of vehicles with an average listing price at or below $20,000 declined 17% month over month, while vehicles with an average listing price at or above $80,000 increased by 9% month over month. The industry continues to rely on higher-income households to drive the new vehicle market, and the focus on high-end vehicles is clear. In February, 41% of inventory in the highest price category (over $80,000) were priced at $100,000 and above. In fact, at the start of March, more than 75,000 new vehicles were available with price tags of more than $100,000. A year ago, there were fewer than 50,000.

Month after month, compact SUVs and full-size pick-ups remain top sellers, and there has been little change in the mix of vehicles sold and brands carrying above-average inventory levels. Given proposed policy changes, especially on tariffs that would most impact more affordable vehicles, the market can expect shifts that mirror current trends.

Fueling the new vehicle market is the tax season, which is off to a strong start, with 28% of all refunds issued totaling $102.25 billion, a 10% increase from last year, according to the most recent data available on Feb. 21. The average refund has risen 7% year over year to $3,453, providing a big cash boost to Main Street USA. Additionally, annual bonuses, typically paid in the first few months of the year, are likely contributing to the influx of funds for new vehicle buyers. However, in February, consumer confidence took a hit amid news cycle chaos, including tariff threats and rising prices, leading to the lowest level of vehicle purchase plans since last February.

New-Vehicle Pricing Declines in February

The average listing price for a new vehicle in the latest report was $48,316, down 0.6% from a month earlier and higher by 2.6% compared to last year. However, 82 models on the market are priced at $40,000 and below, and 31 sit below the $30,000 mark.

The Mitsubishi Mirage remains the last vehicle with an average listing price under $20,000, with the Mirage G4 priced at $19,731 as the model is on a sell down. The next closest competitor, the Nissan Versa, comes in at $20,149 with 103 days’ supply, followed by the outgoing Kia Forte at $22,085 with 56 days’ supply.

As reported earlier this week, the average transaction price (ATP) of a new vehicle in the U.S. in February was $48,039, a slight decline from January but an increase of 1.0% from year-ago levels. In February, new-vehicle sales incentives held steady at 7.1% of ATP, or approximately $3,392.