Dive Brief:

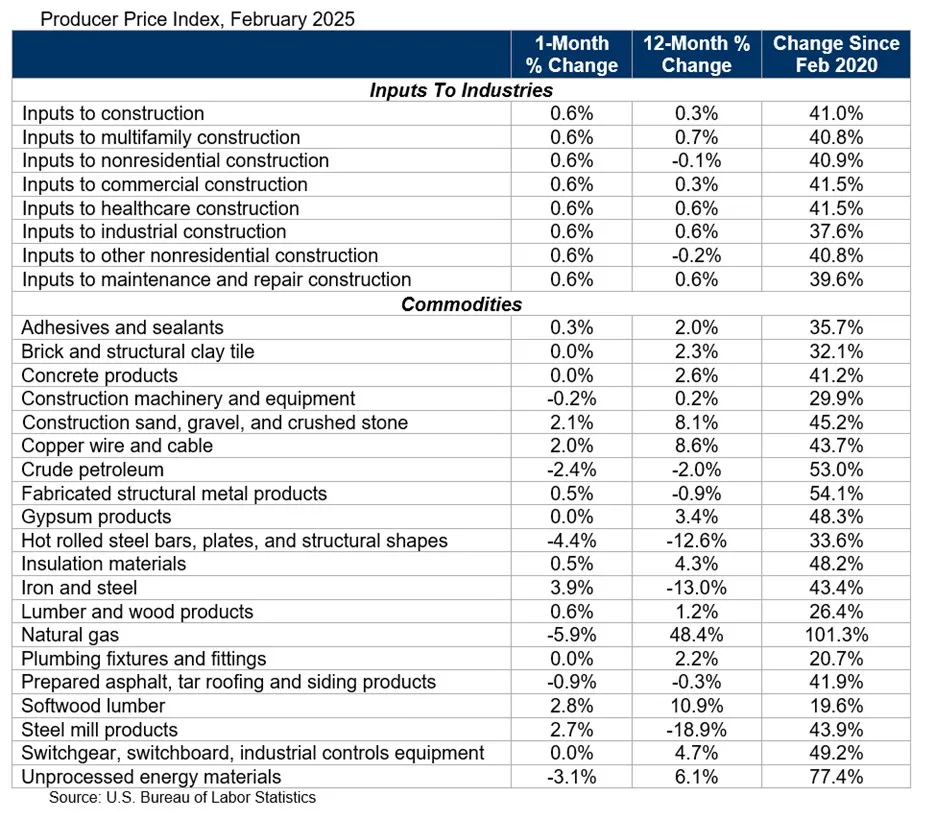

- Nonresidential construction input prices soared in February to notch a red-hot 9% annualized pace year to date, according to Associated Builders and Contractors.

- Overall construction inputs gained 0.6% for the month, following the biggest jump in two years in January, as builders rushed to gather materials ahead of tariffs. Nonresidential prices gained an identical 0.6% in February.

- The increases are a stark departure from the last two years, when costs have largely hovered around the same level. Though costs are still down year over year, “that will likely change in the coming months as tariffs continue to put upward pressure on prices,” said Anirban Basu, ABC’s chief economist, in a news release.

Dive Insight:

After increasing about 40% at the beginning of the COVID-19 pandemic, nonresidential construction inputs have stayed largely flat since 2022.

But President Donald Trump’s whipsaw tariff policies against Canada, Mexico, China and the European Union have quickly changed that trajectory as contractors scrambled to buy up goods before those added fees went into effect.

Now, another impact of those policy changes is playing out, according to ABC, because reduced competition from foreign producers gives American manufacturers the ability to raise prices at home.

“Iron and steel prices rose at a particularly fast rate in February, a result of tariffs providing domestic producers with increased pricing power,” said Basu, who added that prices “have risen at a far-too-hot 9% annualized rate through the first two months of 2025.”

Although ABC’s Construction Confidence Index, which measures how contractors feel about business prospects over the next six months, has remained positive, 23% of surveyed builders now expect their profitability to decline over the next half year, Basu said. That’s the highest share of pessimism since October.

Courtesy of Associated Builders and Contractors

Iron and steel jumped 3.9% in February, while softwood lumber prices surged 2.8%. Steel mill products posted a similar gain of 2.7%.

Unfortunately, these jumps could be just the beginning, according to Ken Simonson, chief economist at the Associated General Contractors of America.

“It’s a bad sign that construction costs have been rising significantly even before most of the Trump administration’s tariffs have taken effect,” said Simonson in a news release emailed to Construction Dive. “Now that many tariffs that hit construction materials are in effect, with more measures pending, construction costs are likely to rise much more.”

Simonson told Construction Dive there are additional reasons for trepidation now, as additional consequences will likely hit the market.

“I’m worried about the impact of retaliatory measures,” he said about other countries imposing fees on U.S. products, which will hurt exports.

“Foreign retaliation makes U.S. products uncompetitive or bans them altogether,” Simonson said. “These impacts will cause businesses and individuals to lose income, hurting demand for structures and their purchases.”