Since the Biden administration designated $52 billion to semiconductor manufacturers through the CHIPS Act, manufacturing spending has grown substantially. Despite these funds, semiconductor manufacturers still face challenges in building facilities, particularly in navigating state water regulations.

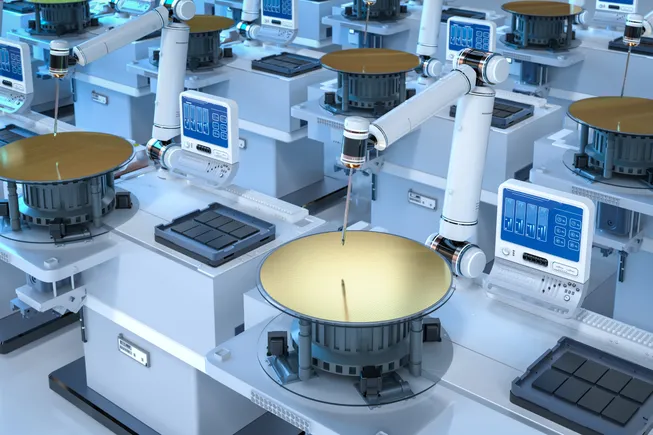

As semiconductor designs become more intricate and able to channel even more information in ever smaller vessels, manufacturing facilities must keep pace. The complexity of chips directly impacts the cost of building and operating these facilities, requiring owners to select general contractors that understand the essential design, construction and legislative considerations associated with semiconductor manufacturing.

Local water regulations are becoming increasingly important for manufacturers to consider due to global water scarcity concerns. The production of semiconductors requires ultrapure water, which is water that has been purified to extremely stringent specifications. A typical facility can consume up to five million gallons of ultrapure water per day. By the end of the manufacturing process, the wastewater produced is contaminated with toxic solvents and heavy metals.

Consequently, securing water supply and implementing advanced water treatment processes are crucial for manufacturers.

“It’s becoming more understood and accepted how valuable a commodity water is,” says Ken Slota, director of design-build and non-municipal water for PCL’s Civil Infrastructure Division. “Either due to state and federal regulations or internal climate goals, we’re seeing more and more manufacturers implementing water reuse.”

What is industrial water reuse, and how is it regulated?

Currently, there is only one national regulation all manufacturers must adhere to in wastewater treatment: The National Pollutant Discharge Elimination System (NPDES) permit program. Established as a part of the Clean Water Act in 1972, the program regulates water pollution by controlling the discharge of pollutants into U.S. waters.

Under NPDES permits, industrial users, including semiconductor manufacturers without onsite industrial water treatment technologies, must pretreat their industrial wastewater before discharging it to Publicly Owned Treatment Works (POTWs), where many municipalities further treat the water for reuse in the community.

Beyond NPDES regulations, specific discharge and reuse requirements vary by the state, county and even down to the local city level. In fact, only 14 states have any official water reuse regulations or guidelines in place for industrial applications.

Four growing states for microchip manufacturing are Arizona, California and Minnesota. These states are all authorized by the EPA to implement their own NPDES programs. Here is a look at some of their core water regulations associated with industrial manufacturing:

Industrial water reuse regulations by state:

Arizona: Arizona is leading the way in new semiconductor manufacturing in the United States. Since the passing of the CHIPS Act, Arizona has attracted over $102 billion in semiconductor projects.

However, due to the state’s desert climate and longstanding drought, strict water regulations have been put into place in recent years. The Colorado River, which supplies 36% of Arizona’s annual water supply, is experiencing a Tier 1 shortage for 2024. Despite drought-induced restrictions, industrial manufacturing is only experiencing a 3% reduction in allotted water usage, significantly less than other industries. This is due in part to the innovative water reuse technologies manufacturers are implementing into their facilities.

American tech company Intel, which has been operating facilities in Arizona for forty years, is proactively engaged in water conservation efforts. The company is actively returning or has reuse projects planned that will restore almost 2.2 billion gallons of water to Arizona water sources every year. Currently, PCL is working on a project for a reclaimed water facility in the town of Chandler, which will significantly boost the water reuse capabilities of Intel and other manufacturers.

California: With one of the world’s largest centers for technology and innovation in California’s Silicon Valley, it’s no surprise the state has over 600 semiconductor manufacturing establishments, the most in the country. The state permits the use of recycled municipal wastewater for industrial manufacturing, following the guidelines of California’s Title 22 Water Recycling Criteria. For industrial applications, these guidelines require specific treatments based on factors such as whether mist is generated and if it comes into contact with employees or the public. The required treatments vary depending on the category of recycled wastewater: Disinfected Tertiary or Disinfected Secondary 23.

Disinfected Tertiary water can come into contact with workers and is used in industrial cooling or air conditioning systems with cooling towers, evaporative condensers or mist-creating sprays. This water undergoes three steps: primary and secondary treatments, followed by filtration and finally, a tertiary (third) treatment that includes disinfection.

Disinfected Secondary 23 water is intended for uses where it does not contact workers or for industrial cooling or air conditioning systems without cooling towers, evaporative condensers or mist. This water must go through primary and secondary treatments and filtration.

Minnesota: Semiconductor production is on the rise in Minnesota, with over 150 semiconductor manufacturing companies now operating in the state, a 13.5% increase from 2021 to 2023. In early 2024, Bloomington-based Polar Semiconductor LLC announced a $525 million expansion, aiming to boost the facility’s output by 50%. Yet manufacturers should be aware that Minnesota is one of 14 states with water reuse regulations for industrial applications. Minnesota’s regulations are based on California’s Title 22 Water Recycling Criteria, which were among the first detailed regulations designed to ensure that wastewater reuse is safe for human health.

Leaders in industrial water treatment technology:

As of the 2024 summer, 33 U.S. states are experiencing a “moderate” to “extreme” drought. This affects over 50 million people and with continued impacts of climate change, that number will grow. Additionally, the demand for semiconductors to meet evolving technological needs alongside the growth of stateside manufacturing is leading to a major demand for water.

However, industrial water treatment technology is often neglected in the initial planning stages of these facilities.

“Many times, the wastewater infrastructure scope is a separate package and not included up front in the base facility planning process,” says PCL’s Andy Ahrendt, director of advanced manufacturing. “Having an industry expert like PCL who can design and build the wastewater project components is an advantage. We understand the process and how to design and build these facilities. We know what to ask the owners, operators and facility designers, and what to expect from the municipalities we build in.”

PCL Construction is no stranger to these types of facilities, with Advanced Water Purification Facility (AWPF) projects like EPWater in El Paso, Texas currently underway. Texas is also quickly growing as a top region for semiconductor manufacturing: Arizona and Texas together account for over half of the total investment and 35% of the projected jobs in semiconductor manufacturing.

“A lot of the technologies and processes to treat public wastewater treatment facilities are the same at private, industrial wastewater treatment facilities,” says Slota. “Having the expertise to design and complete both while mitigating risk is a huge benefit to any client.”

With a deep backlog of successful water and wastewater infrastructure construction projects in municipalities across the U.S., PCL is intimately familiar with providing innovative solutions to meet each community’s unique water challenges for both public and private clients.

“Sustainability has increasingly become a key consideration in location selection and design. Additionally, water regulations are ever-changing at every level, making it crucial for growing manufacturers to collaborate with industry experts who comprehend both the value of their projects and the diverse regulations they face. Understanding the unique nature of every manufacturing plant and project, PCL’s collaborative approach enables teams to thoroughly understand each plant’s specific water needs and identify the most sustainable ways to manage water usage,” says Ahrendt.